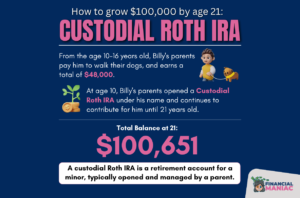

Understanding Custodial Roth IRAs

A Custodial Roth IRA is not just any retirement account. It’s designed specifically for minors (those under 18) to start saving for their future. The minor will own the account, but an adult manages and funds it until the minor becomes an adult. It’s like a regular Roth IRA but designed for children.

Who Has Control Over the Account?

A Roth IRA for Kids offers the same advantages as a regular Roth IRA but is designed for children under 18. Since minors cannot typically open brokerage accounts in their own name until they turn 18, a Roth IRA for Kids requires an adult to act as custodian.

The custodian controls the child’s Roth IRA, handling contributions, investments, distributions, and receiving statements. The minor is the beneficial owner, and the funds must benefit them. When the minor turns 18 or 21, depending on the state, the assets are transferred to a new account in their name.

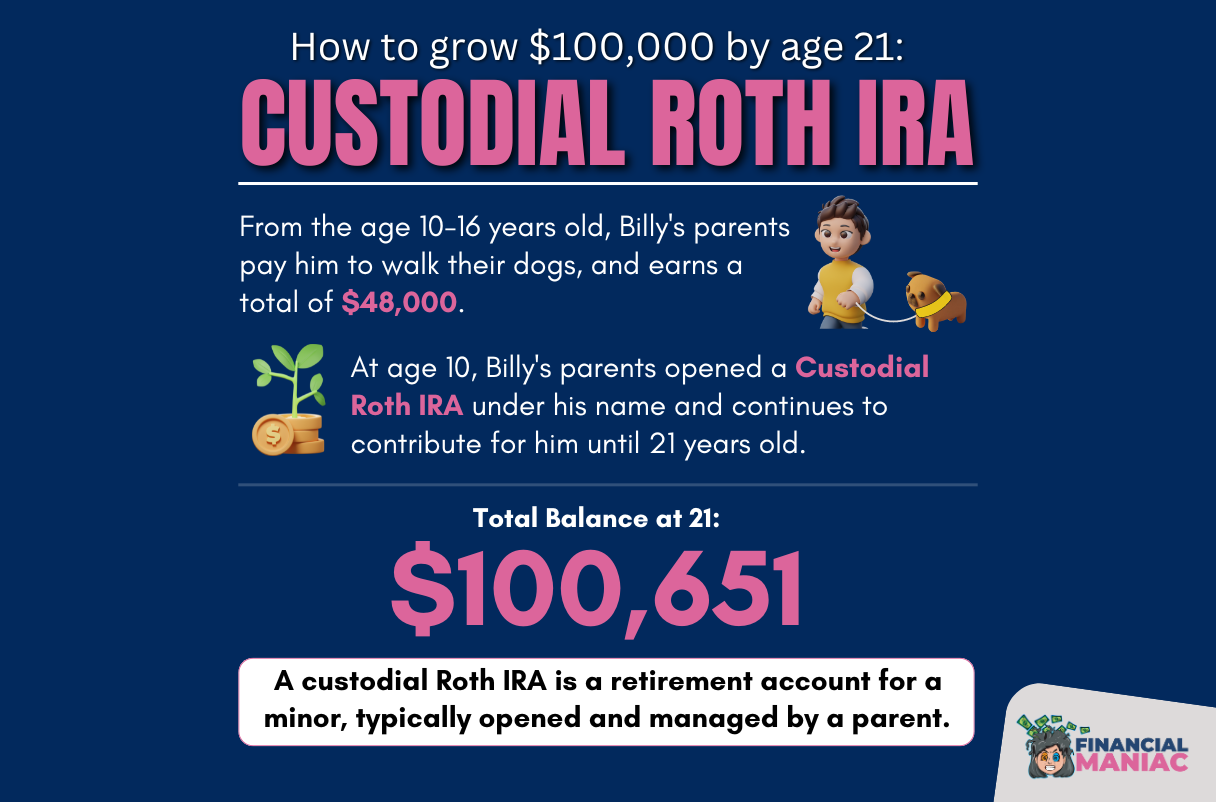

The Child Must Have Earned Income

A contribution to a custodial Roth IRA for Kids can be made if a minor earns income during the year. The IRS defines earned income as taxable income and wages—money earned from a W-2 job or from self-employment gigs: cutting the grass, babysitting, or dog walking.

For example, if you paid your son $5,000 to walk your dogs, you could contribute up to $5,000 to a Roth IRA in his name.

NOTE: The Internal Revenue Service requires all individuals, regardless of age, to submit a tax return.

How Custodial Roth IRAs Operate

- Account Setup

- A custodial Roth IRA is typically opened in the name of a minor by an adult, often a parent or legal guardian.

- The minor legally owns the account, but the adult manages it until the minor reaches the age of majority, which is usually 18 or 21, depending on the state.

- Funding the Account

- The minor must have earned income, such as wages from a part-time job or earnings from self-employment.

- Contributions are made using after-tax income, meaning there’s no immediate tax deduction for the contributions.

- Tax Advantages

- The money in the account grows tax-free.

- Withdrawals during retirement are also tax-free if certain conditions are met.

Advantages of a Custodial Roth IRA

- Early Start on Savings

- Starting to save at a young age maximizes the benefit of compound interest, where the investment earnings generate more earnings over time.

- Tax-Free Growth

- The account’s investments grow without being taxed yearly, helping to build wealth more effectively.

- Flexible Use of Contributions

- You are allowed to withdraw contributions at any time without penalties, providing financial flexibility if needed before retirement. However, you cannot withdraw the earnings without penalties.

Important Things to Consider

- Contribution Limits:

For 2024, the annual contribution limit is $7,000 or the total of the minor’s earned income for the year, whichever is less. - Age of Majority:

When the minor turns 18 or 21, they get full control of the account and its money.

- Investment Options:

Custodial Roth IRAs offer many different investment options, including individual stocks, government and corporate bonds, and different types of mutual funds. This enables account holders to build a diverse investment portfolio.

Steps to Begin

- Opening the Account:

Choose a brokerage firm and fill out the paperwork to open the custodial Roth IRA. - Funding the Account:

Deposit the minor’s earned income into the account, adhering to the annual contribution limits. - Choosing Investments:

Pick investments that align with the minor’s risk tolerance and long-term financial goals (here is one of my favorite books to learn about investments).

Conclusion

A Custodial Roth IRA is an excellent way to start helping minors or your kids get a head start on saving for retirement. By learning the fundamentals and beginning the savings process early, you can take full advantage of tax-free growth and build a solid financial foundation for the future.

Here are some of my favorite books on personal finance.

Disclaimer: As an Amazon Associate, I earn commission from qualifying purchases.

Instagram Link to this post:

https://www.instagram.com/p/C8kLPO4J7Uo/