What is Good Debt?

Debt is often considered a negative word, but did you know there is something called “good debt”? Good debt is debt that can help you increase your net worth or generate future income.

Examples of Good Debt

Education Loans

Education can make a big difference in your income and job prospects. The more education you have, the higher your earning potential. That’s because educated workers are more likely to find good-paying jobs and have an easier time finding new ones if they need to.

Investing in a college or technical degree is a smart decision as it can pay for itself within just a few years of starting work. However, it is important to understand that not all degrees are equally valuable.

Therefore, it is important to consider the following carefully:

a. The job opportunities in your field of study

b. If you should go back to school for an advanced degree

c. Weighing the pros and cons of your loan amount versus the salary of your future job position (College Debt to Earning)

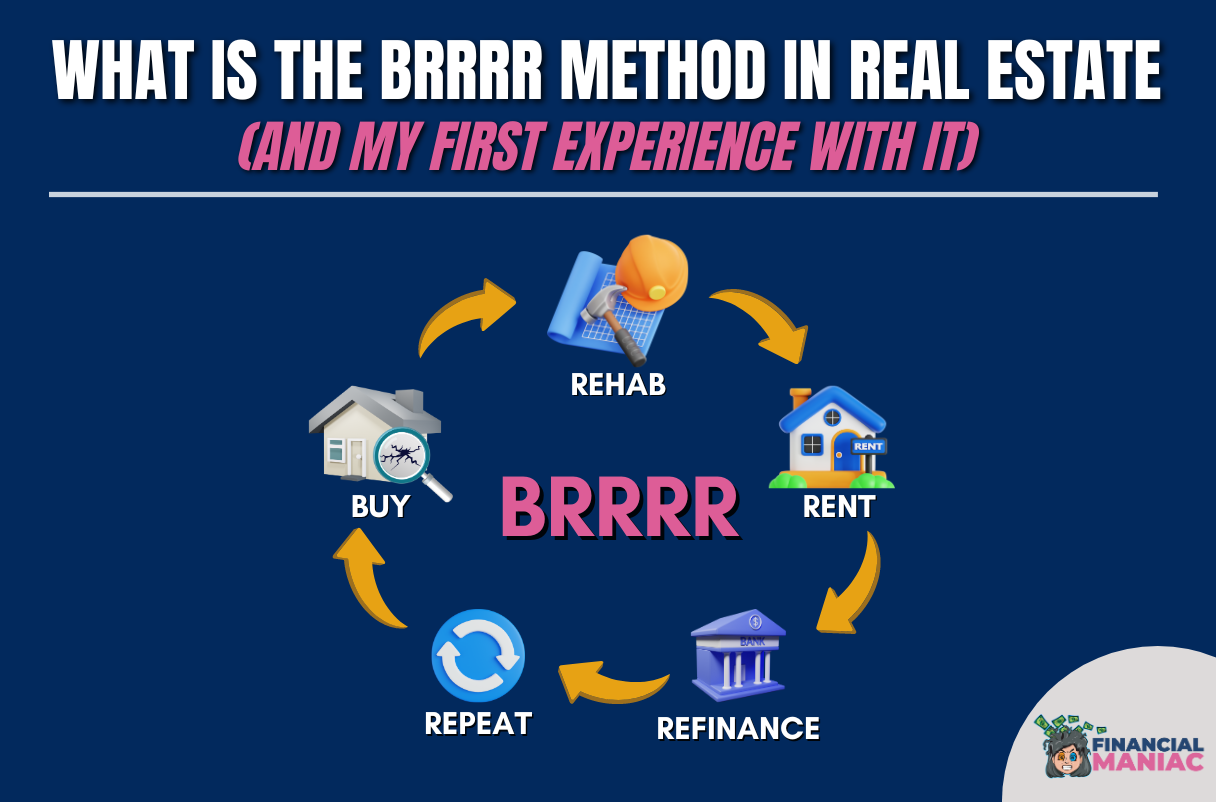

Mortgages

Mortgages are a type of loan used to buy a house or real estate.

Mortgage loans are among the safest types of loans that lending institutions can issue to borrowers because the property guarantees that the loaned money can be recovered if there is ever a problem.

According to a recent survey, over 50% of Americans consider mortgages to be a form of good debt. Despite this, some people are hesitant to take out mortgage loans due to the large sums of money involved. However, there are several advantages to having a home mortgage.

For instance:

-

- It can increase your net worth

-

- it may be more beneficial than renting

-

- It allows you to build equity over time

-

- It offers tax breaks

-

- It can bring long-term financial gains as the value of the property increases over time

Small Business Loans

If you are a small business owner or planning to start one, taking a small business loan can be a sensible decision to invest in your company.

However, it’s worth noting that small business loans come with varying terms. It’s best to opt for loans with lower interest rates and shorter repayment periods. You can use the funds to reinvest in your business, creating long-term wealth and value, which makes it a good debt.

What is Bad Debt?

On the other hand, bad debt is a financial trap that can lead to a downward spiral. It’s debt used to finance purchases that will not increase your net worth or future income. It often comes with a high interest or variable rate that can skyrocket in the future, making it difficult and expensive to repay.

Examples of Bad Debt

Credit Card Debt

Credit cards can be expensive for borrowing money, with the average interest rate on new credit cards hovering close to 24%. People often use credit cards to buy things like clothes, electronics, food, and vacations. But, paying interest on these items can be costly because they lose value over time.

Payday Loans

Some people rely on short-term payday loans when they can’t get other types of financing. The issue with payday loans also called cash advance loans, is that they charge very high fees, equivalent to paying almost 400% APR. This makes them one of the most expensive ways to borrow money. So in general, it’s important to avoid payday loans if possible.

High-Interest Personal Loans

High-interest loans are considered bad debt, while low-interest personal loans can be beneficial if used strategically. With a good credit score, you can get interest rates as low as single digits. However, if you have a poor credit score, interest rates can skyrocket, making these loans a lousy financing choice. It’s better to avoid using high-interest loans to buy items that don’t increase in value.

Car Loans

When you take out a long-term auto loan, you’ll keep paying for the car even after it’s lost a significant amount of its value. Additionally, longer loan terms come with higher interest rates. To avoid this, go for a shorter repayment period when taking out a car loan, as long as the payment is affordable for you. Remember that cars are depreciating assets, so it’s best to choose a loan term that won’t make you pay more than what the car is worth.

What to Do to Avoid Bad Debt

Before making a purchase that increases your debt, ask yourself if it will benefit you in the long term or is just a short-term desire. If you can’t afford it and has no financial value, it’s best to avoid that purchase. Having an emergency fund to cover unexpected expenses is also a good idea, so you don’t have to use credit cards.

Remember to ask yourself whether a purchase will benefit you in the long term or if it is just a short-term desire before increasing your debt. If you cannot afford it and it has no financial value, try your best to avoid it. Maintaining an emergency fund to cover unexpected expenses is also a good idea, so you do not have to resort to credit cards. It is always beneficial to keep your debt-to-credit ratio as low as possible, focus on paying off your current debt, and avoid new purchases. Paying your bills on time is also crucial to avoid bad debt.

Conclusion

All in all, to make smart financial choices, it is important to distinguish between good and bad debt. Good debt can enhance your overall value or generate revenue in the future, while bad debt can result in financial strain. In short, identifying good versus bad debt is key to good financial management!

Recommendations: If you’re looking to expand your knowledge on this topic, I highly recommend checking out the book “Rich Dad Poor Dad” by Robert Kiyosaki. This book has been instrumental in teaching me about the difference between good and bad debt, and I’m confident it can do the same for you!

Here are more of my favorite books in personal finance!

Disclaimer: As an Amazon Associate, I earn commission from qualifying purchases.