Thus, the Ava Credit Card, issued by Evolve Bank & Trust, removes the guesswork and long waiting time to improve your credit score. Also, unlike other regular credit cards, it has strict limits on spending amounts and categories.

What’s more, the Ava Card isn’t for making purchases; its purpose is to grow your credit.

7 Essential Things You Need to Know About the Ava Credit Card

The Ava Credit Card represents a paradigm shift in credit card offerings, launched with the aim of providing a user-centric experience that caters to the diverse needs of modern-day consumers. Here’s everything you need to know about the Ava Credit Card.

1. Ava Credit Cards Helps You Improve Your Credit Quickly

Here’s a list of a few things that affect your credit scores:

a) History of Payment: It looks at whether you paid your bills on time or not.

b) Credit Usage: This is the percentage of your credit limit that you use(It’s better to use less).

c) Credit Account Duration: Having older accounts is beneficial.

d) Credit Mix: It includes credit cards and different kinds of loans, including auto loans and mortgages.

e) Recent Credit Applications: Applying for credit or a loan can temporarily lower your credit scores.

Moreover, the Ava Credit Card focuses on improving credit usage and payment history. Let’s see how it works:

- You get a credit limit of $2,500, but there are restrictions on how much you can use and where. Although this isn’t good for your buying ability, it keeps the credit utilization lower.

- If you use the Ava Card to pay for your monthly subscription, you have to pay the bill within seven days. The amount will be taken from the bank account you connected to the card when you signed up. It is mandatory to pay the bill in full, and Ava Card does not charge any interest.

What’s more, Ava also updates your credit score (just 24 hours after your auto payment) with the three main credit bureaus every week. It helps boost your credit score faster.

2. You Can Combine it With Another Ava Product

You have the option to leverage the ‘save & build credit’ functionality to potentially speed up the process of building your credit. This works more like a savings loan, requiring you to deposit $30 per month for a duration of 12 months into your Ava app wallet.

What’s more, Ava promptly sends all of these payments to the credit bureaus as on-time loan payments, highlighting the need to maintain timely payments in order to avoid any negative effect on the credit score.

Additionally, upon completion of the 12-month period, you will get back the full refund of the deposited money.

Hence, this particular feature targets two pivotal elements influencing credit scores:

- Payment history

- Credit mix

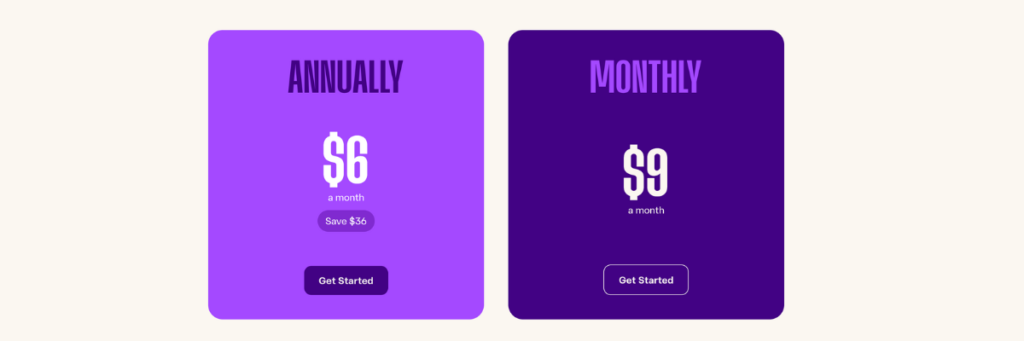

3. There is a Monthly Fee for Using Ava

If you choose the yearly plan, Ava charges $6 each month, totaling $72 for the whole year. You can also opt for monthly payments which are $9 per month, adding up to $108/year.

While the idea of boosting your credit quickly may justify the cost, there are alternative options, including starter credit cards with zero annual fees, which might prove out to be more budget-friendly.

This is true only if you manage those cards wisely like:

- Paying your bills on time

- Using a small part of the credit limit and avoiding debt

4. No Hidden Fees or Interest Rate

You get everything in the Ava for one price, with no interest and hidden fees on either of their products. Also, this transparency assists you in building credit in a predictable and fast way.

5. Ava Credit Card Can Only be Used for Certain Subscription Payments

Although with Ava Credit Card you have an extended credit limit, you can only spend up to $25 each month on specific subscription services.

Also, the Ava website mentions that you may be able to spend more than $25 “depending on your spend limit,” but it doesn’t give clear details about what qualifies for that.

The good news is that the list of eligible services includes a bunch of options. You can use the Ava Card for subscriptions, including Walmart+ and Amazon Prime, and streaming services including, Netflix, Hulu, YouTube Premium, Spotify, and other services such as insurance and cell phone providers.

6. Enhanced Security

Security is a paramount concern with credit cards, and Ava doesn’t disappoint. The Ava Credit Card includes advanced security features, including biometric authentication and real-time fraud detection.

What’s more, Ava ensures the protection of your data by refraining from selling it or storing banking logins. Therefore, your personal information remains securely maintained with 256-bit encryption.

7. Limited Card Advancement Options

If the Ava Credit Card boosts your credit score, you will have a better chance of getting approved for different credit cards.

However, the Ava Card doesn’t work like other regular cards, and there isn’t another card from Ava that you can switch to.

Thus, once you achieve your credit score goals, it’s a good idea to drop the membership and explore other cards that better cater to your needs.

Final Words

Ava Credit Card stands out with its unique approach to credit-building. With transparent pricing, no hidden fees, and a focus on security, Ava offers a user-friendly platform to enhance your credit score.

Even though there’s no traditional card progression, the potential credit benefits make it a valuable tool. With Ava’s purpose-built products for improving credit, you are on track to achieve a higher credit score on your credit-building journey!