Entrepreneurship

After gaining tremendous experience from multiple Fortune 500 Tech companies, I knew that the years in data, marketing, and technology were unique and a much-needed niche for companies.

I eventually decided to start my own digital marketing technology agency.

I hired and am currently hiring some of the best in the marketing industry, making a significant impact on our clients. I discovered my strengths and was determined to use my specialized skills to propel my personal growth.

Eventually, I was able to work with CMOs, Business Founders, and Executives to solve their marketing needs.

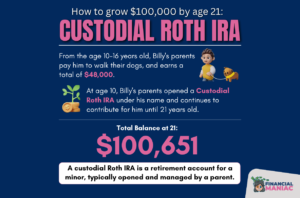

Financial Investments To Financial Freedom

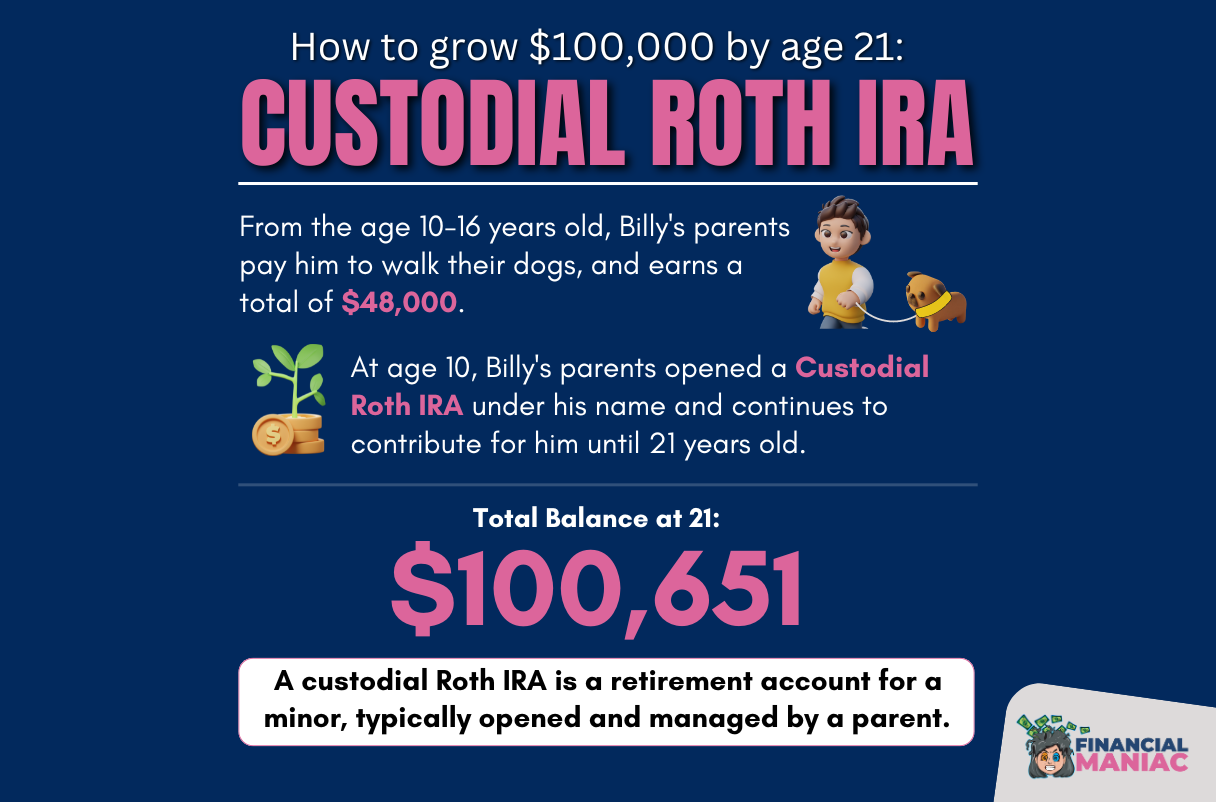

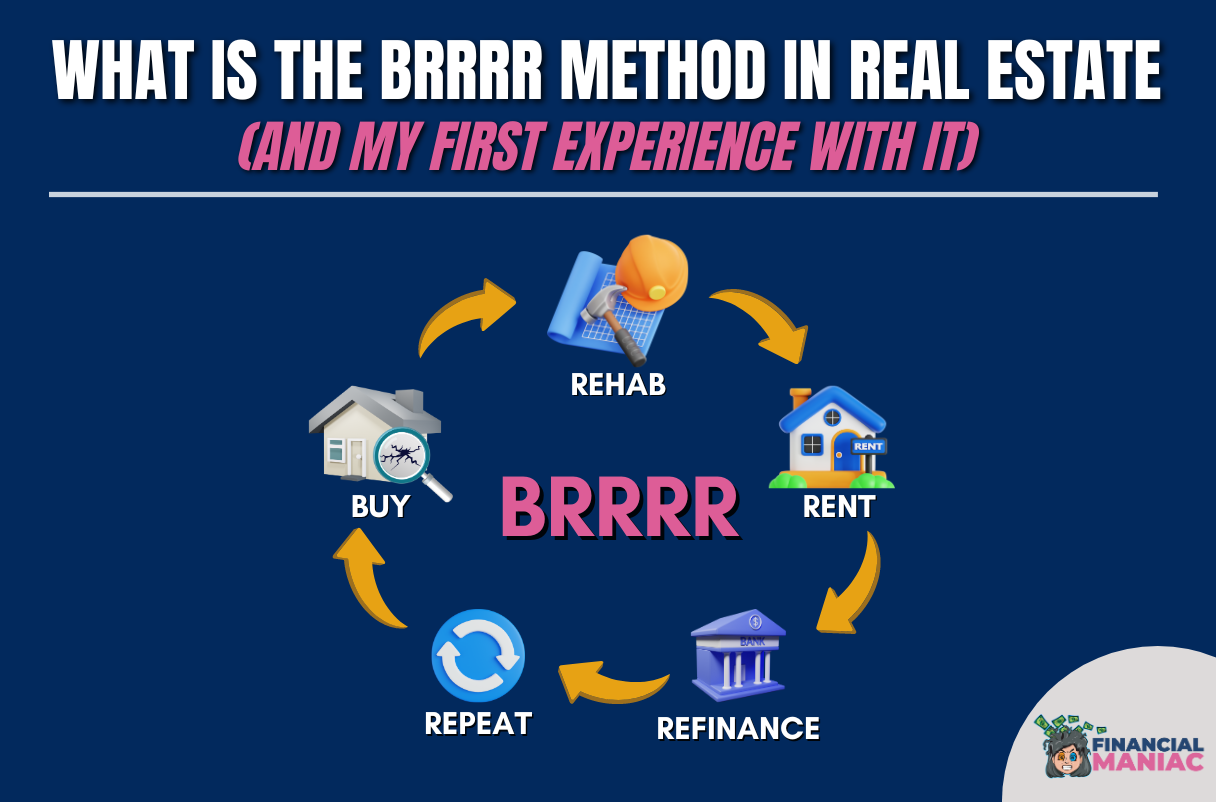

I’ve invested my money in real estate and long-term retirement plans.

However, my financial literacy knowledge came from entrepreneurship and owning my own business.

I didn’t see a way to achieve financial stability while continuing to run my business at the same rate. I decided to explore new avenues for my money to grow passively. I increased my investments both in my brokerage account and in real estate. These decisions led to a significant increase in my net worth over the years.

Over the last 10 years, my portfolio has consistently outperformed my financial goals, reaching eight figures and ensuring a comfortable retirement living (if I wanted to).

Today, I manage 11+ real estate properties which include:

- Residential Properties

- Commercial Buildings

- Luxury Houses

- Airbnb Properties

3 Things I’ve Learned Becoming Financially Free

Everyone wishes to achieve financial freedom. But wishful thinking alone can’t get anyone to be successful.

So, from my experience, I will share the three principles of achieving financial freedom:

A. Build a strong credit score with a formal plan as soon as possible. It will help you reduce debt costs with easy access to financing from the bank.

B. Leverage the power of action and put your income, skills, and assets to work for you.

C. Hustle to create diversified income sources by learning new skills and investing in yourself.

Having Some Troubled Time? Everything Can Be Fixed

I have seen many people struggle in their professional and personal lives. I went through the same hardships.

But I believe if you have a solid plan, EVERYTHING CAN BE FIXED.

Over the years, I have become a Financial Maniac because of my extensive experience in real estate, investing, entrepreneurship, and knowledge in wanting to have Financial Literacy and Freedom.

I want to share the wealth of that knowledge with others to help them achieve Financial Success.

I’d love to walk anyone through the fundamentals of turning dreams into success stories.

Thank you for taking the time to visit my blog. I am excited that we’re connected and thrilled to be joining you all in this journey to Financial Freedom & Education!