1. You enjoy lower taxes

There are many tax advantages to investing in a 401(k) plan. The best thing is that your contributions are deducted from your paycheck first before you pay any taxes. So when you have a chance of pre-tax deductions, you have the power to lower the total taxable income.

When you lower your taxable income, you will end up paying fewer taxes because your total net income will fall under a lower tax bracket. Another thing is all your pre-tax contributions will not be subjected to any form of taxation until such a time when you decide to withdraw your savings during the retirement period.

2. You have the contribution powers at your fingertips

If you earn a higher income, you can save more in taxes by increasing your monthly contributions to the maximum allowable for the year.

If you find yourself with many financial obligations along the way, you can lower your contributions to reflect your current financial capabilities. For example, I made several monthly contribution adjustments due to personal issues over the years, so always remember that it is okay to make these adjustments.

Controlling what you can contribute towards your retirement savings ensures that you live a financially balanced lifestyle.

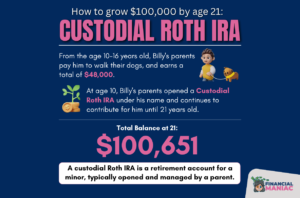

3. Compounding Interest benefits

The earlier you start saving for your retirement, the better. I started investing in a 401(k) retirement plan in my early 20s, and I benefited significantly from the compounding interest. When you save money in a traditional 401(k) plan, it will earn compound interest every year.

By compounding both the principal and the accumulated interest, I grew my long-term retirement savings to $1M by the age of 45 by starting early in my career.

Therefore, if you want to get impressive retirement benefits in the future, the time to start saving is now so that you can take advantage of the power of compounding savings.

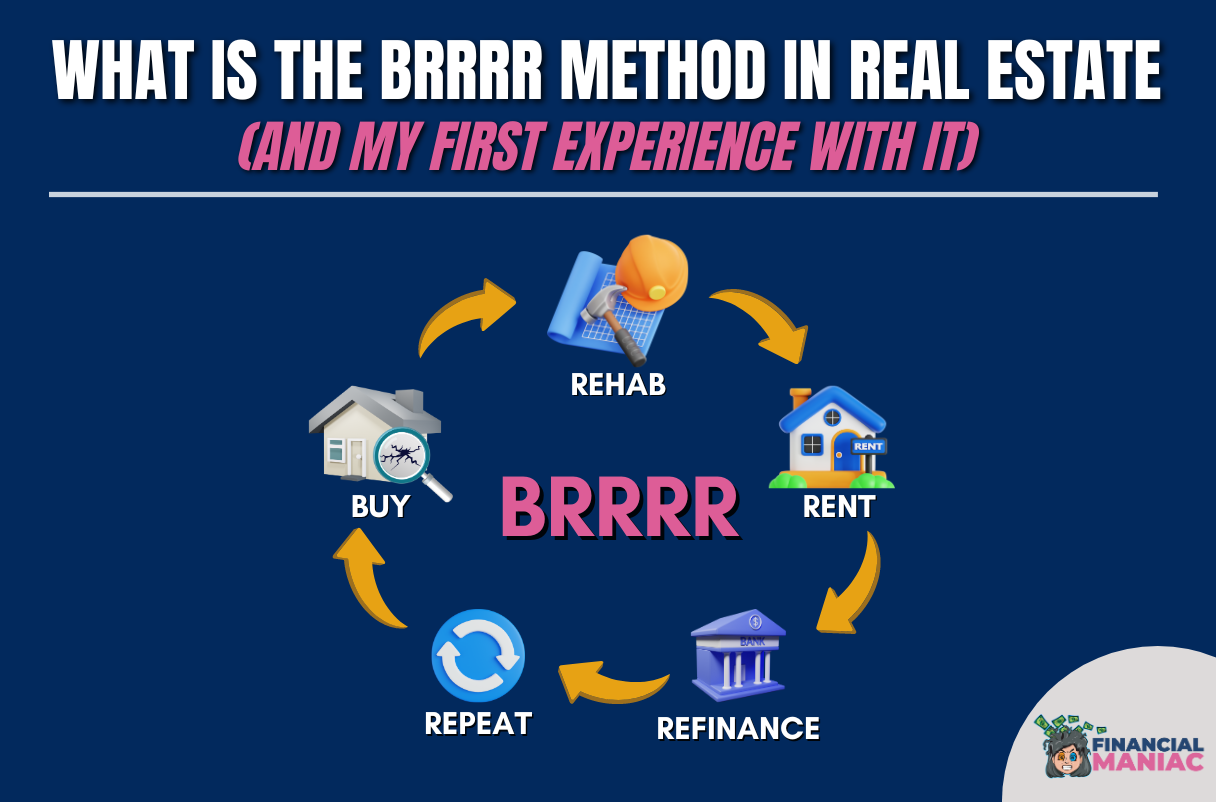

4. It’s dynamic and no contribution is lost

When you contribute to a 401(k) retirement savings plan with an employer, you can later move your plan and all your contributions to a new employer (if you decide to do this).

I have worked with several employers throughout my career, and I have always carried my 401(k) plan over.

Over the years, as your career progresses, your retirement savings package continues to grow as the money contributed plus interest earned over the years can be invested in profit-making ventures (for me, it was in real estate investing).

Therefore, you should never worry about your retirement contributions when you change your employer since you can take your current savings to your new employer.

5. Seamless automatic contributions

When I started saving for my retirement, I opted for automatic payroll deductions. All of my contributions were channeled to my 401(k) plan, so I didn’t have to worry about failing to submit my contributions.

You will feel motivated to secure your future financial freedom when you opt for automatic deductions, which has made it much easier for me to save.

What I’ve Learned

Some of the fruits of a successful future retirement will come from planning early. You will channel more money to your long-term retirement package when you start early, therefore, building a solid retirement plan.

I have managed to secure a financially independent retirement fortune through a 401(k) plan, and I believe that anyone can do this; it just takes proper financial education.

Take the first step now and plan your future by investing in a 401(k) retirement plan.

Looking forward to joining you all in this journey to Financial Freedom & Education!