INVESTING

Compound Interest Calculator

Find out how much money you can earn with compound interest

Use this calculator to see how your money grows over time, as you earn interest on your account balance. Fill out the fields for initial investment, planned contributions, rate of return, frequency, and length of investment to estimate future value.

Guide for Using the Compound Interest Calculator

- Total future balance: This is the total amount you have in your account, including your own contributions and the interest earnings you’ve accumulated so far.

- Total interest: This is the amount of money you’ve earned as interest on your investment.

- Total contributions: This is the total amount of money you’ve deposited into your account, including all the initial deposits and any additional contributions you may have made over time.

What Is Compound Interest, and How Do You Calculate It?

To calculate your investment returns, you need to provide the following information:

- 1. Initial Investment: This is the amount of money you will deposit when you first open an investment account.

2. Contribution Amount: If you plan to make additional deposits, you need to specify how much and how frequently you will add them. Note that some investments do not require further contributions, while others allow them.

3. Interest Rate: This is the percentage return on your investment. Also, indicate how often the interest will compound. This means how often interest will be calculated on your deposit. The frequency may vary, and it could be monthly or annually on this calculator.

4. Length of Investment: This is the duration you plan to hold your investment account before making a withdrawal.

What is a Compound Interest Calculator Used for?

Compound interest is a powerful tool for calculating interest on your savings and investments. It works by adding the interest you earn to your original balance at regular intervals, which then earns interest on the new combined balance. This compounding effect can significantly increase your returns over time. With compound interest, your savings grow faster than with other methods, allowing you to reach your financial goals sooner. In fact, the ultimate goal with retirement accounts is to accumulate enough savings to live off the earnings of your account, rather than depleting the principal balance.

By harnessing the power of compound interest, you can make your money work harder for you and achieve your financial objectives more quickly.

Compound Interest Formula

Here is how compound interest is calculated for investments in which you only make one deposit (such as a certificate of deposit, or CD):

A = P (1 + r/n)nt

- A is the total amount of money you have at the end

- P is your initial investment amount

- r is your interest rate, expressed as a decimal

- n is how many times your interest is compounded each year

- t is how many years your money is invested

Compounding Frequency

The compounding frequency has a big effect on how fast you earn interest, too. The more often your interest is compounded, the faster it adds up.

For example, consider two investments that pay a 5% interest rate, but one is compounded monthly and the other is compounded annually. You’ll earn more interest with the investment that compounds monthly because that’s 12 chances for your balance to increase throughout the year, rather than once at the end.

How Does Compound Interest Work With Investments?

Compound interest is a powerful concept commonly utilized in investments. Instead of just earning returns based on the initial investment (known as the principal), compound interest allows you to earn returns on your previous earnings as well.

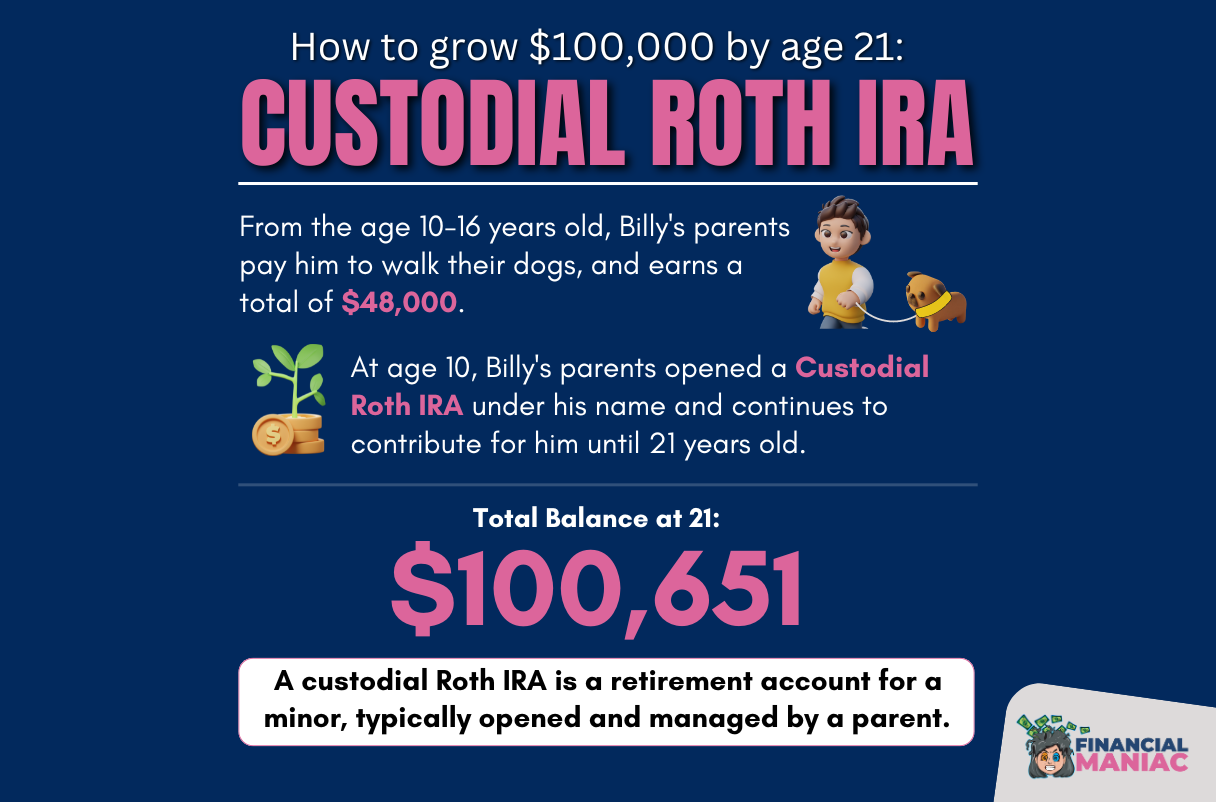

This results in your balance growing much faster, which is particularly advantageous for long-term investments such as retirement accounts. Starting to save for retirement early can lead to a significant portion of your retirement savings being composed of market returns or earnings rather than solely your contributions.

This underscores the importance of beginning to save at a young age. By allowing your money to work for you over time, you can potentially reduce the amount of effort and time required to reach your financial goals.